As we approach the new year, it's essential to stay ahead of the curve when it comes to understanding the upcoming changes in IRS limits. The experts at

milliman.com have released their 2026 IRS Limits Forecast, providing valuable insights into what we can expect in the coming year. In this article, we'll break down the key takeaways from the forecast and what they mean for you.

Introduction to IRS Limits

The Internal Revenue Service (IRS) sets limits on various aspects of tax-advantaged plans, such as 401(k) and IRA contributions, health savings accounts (HSAs), and flexible spending accounts (FSAs). These limits are adjusted annually to reflect cost-of-living increases. Understanding the IRS limits is crucial for individuals and employers to maximize their tax benefits and plan for the future.

2026 IRS Limits Forecast Highlights

The 2026 IRS Limits Forecast from milliman.com provides a comprehensive overview of the expected changes in IRS limits. Some of the key highlights include:

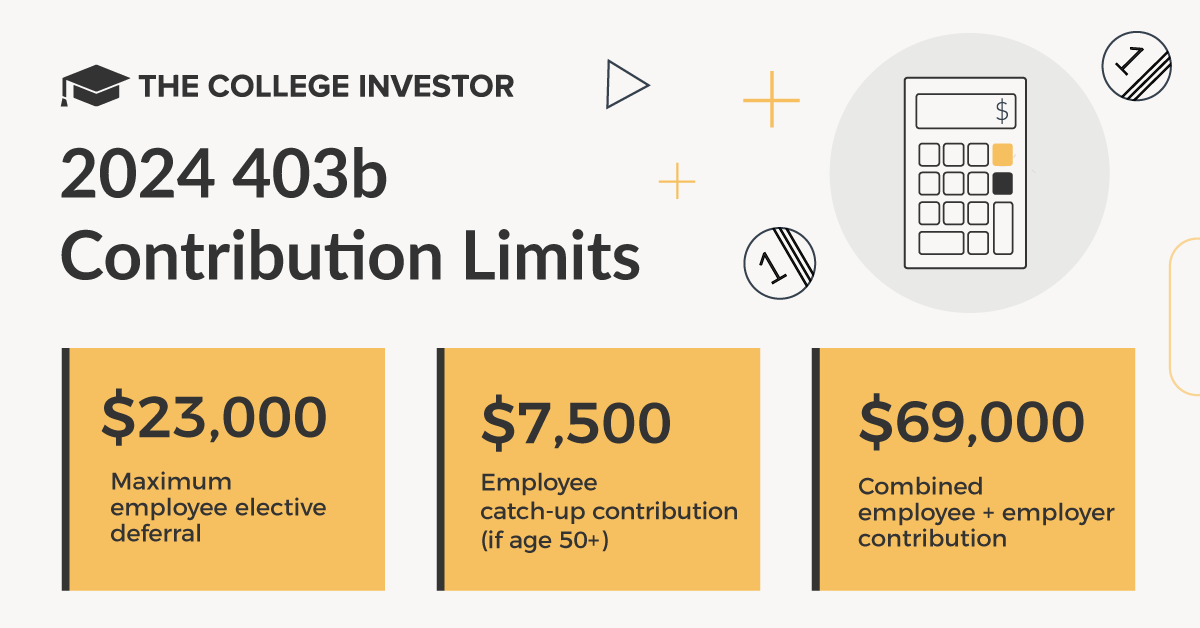

401(k) and IRA contribution limits: The forecast predicts an increase in the contribution limits for 401(k) and IRA plans, allowing individuals to save more for retirement.

HSA limits: The limits for health savings accounts (HSAs) are expected to rise, providing individuals with more opportunities to save for medical expenses.

FSA limits: The forecast also predicts an increase in the limits for flexible spending accounts (FSAs), which can be used for healthcare and dependent care expenses.

Impact on Individuals and Employers

The changes in IRS limits can have a significant impact on both individuals and employers. For individuals, understanding the new limits can help them:

Maximize their retirement savings: By contributing more to their 401(k) or IRA plans, individuals can take advantage of tax benefits and build a more secure retirement.

Plan for healthcare expenses: The increased HSA limits can provide individuals with more opportunities to save for medical expenses, reducing their out-of-pocket costs.

Make informed decisions about FSAs: The forecasted increase in FSA limits can help individuals make more informed decisions about their healthcare and dependent care expenses.

For employers, the changes in IRS limits can impact their:

Benefits planning: Employers need to stay up-to-date on the latest IRS limits to ensure they are offering competitive benefits packages to their employees.

Compliance: Employers must comply with the new IRS limits to avoid any potential penalties or fines.

The 2026 IRS Limits Forecast from milliman.com provides valuable insights into the expected changes in IRS limits. By understanding these changes, individuals and employers can make informed decisions about their tax-advantaged plans and benefits. Whether you're planning for retirement, healthcare expenses, or dependent care, staying ahead of the curve on IRS limits is essential. Visit

milliman.com to learn more about the 2026 IRS Limits Forecast and how it can impact your financial planning.

Note: The information in this article is based on the forecasted IRS limits and is subject to change. It's essential to consult with a financial advisor or tax professional to ensure you are in compliance with the latest IRS regulations.